Why Unconventional Wells Are More Expensive Up-Front

In the world of oil and gas, not all wells are created equal—especially on the balance sheet. While a traditional conventional well might represent a known and manageable investment, drilling an unconventional shale well is a massive capital-intensive project from day one. If you've ever wondered why modern fracking operations require such large financial commitments, the answer lies in the intense complexity and scale of the engineering required.

The Simplicity of Conventional Wells

To understand why unconventional wells are so expensive, it helps to first look at their conventional counterparts. A standard conventional onshore well involves:

Drilling a vertical hole straight down to the reservoir.

Installing steel casing and cement to reinforce the wellbore.

Completing the well, which may involve simple perforations to allow the naturally pressurized oil and gas to flow.

The geology does most of the work. The reservoir rock is permeable, the hydrocarbons are concentrated, and the pressure is high. This simplicity translates into a lower upfront cost. The primary expenses are the rig day-rate, standard materials, and the time it takes to drill to depth.

The Multi-Stage Price Tag of Unconventional Wells

Unconventional wells, designed to unlock resources from tight shale formations, are in a different financial league. Their high cost is the direct result of the complex techniques needed to make the rock give up its resources. Here’s where the money goes:

1. The Rig and Pad Costs:

Drilling a long horizontal well is a slow, precise operation. It requires more powerful and sophisticated drilling rigs that command higher day-rates. Furthermore, because a single horizontal well can drain a large area, companies often use a single "pad" to drill multiple wells (sometimes over a dozen) fanning out in different directions. While this is efficient in the long run, preparing a large multi-well pad with extensive infrastructure is a major initial investment.

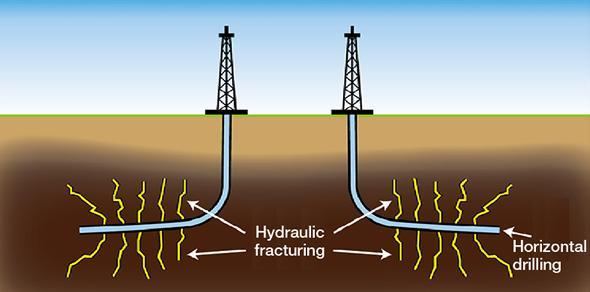

2. The "Longer" Wellbore:

An unconventional well isn't just deep; it's long. A typical well might go down 10,000 feet vertically and then turn to drill another 10,000 feet (or more) horizontally. This means you are paying for twice the drilling time, twice the drill pipe, twice the drilling mud, and twice the steel casing. The cost of materials and horsepower for a 20,000-foot wellbore is exponentially higher than for a 10,000-foot vertical hole.

3. The High-Tech Completion: Hydraulic Fracturing

This is the single biggest cost driver. A conventional completion is relatively simple; an unconventional fracking operation is a massive, industrial undertaking. For each well:

Water & Sand: A single frack job can use 5-10 million gallons of water and thousands of tons of sand. Sourcing, transporting, and storing these vast quantities is incredibly expensive.

Pressure Pumping: Fleets of powerful specialized trucks, often numbering 20 or more, are required to pump the fluid at extremely high pressure. This equipment and the manpower to run it represent a huge cost.

Staging: A horizontal well is fractured in stages, isolated one by one. Each stage requires its own set of perforations and fracking fluid. A well with 40 stages is essentially 40 separate mini-fracking operations, each adding to the time and cost.

The Financial Trade-Off

While the upfront cost of an unconventional well is significantly higher—often two to three times that of a conventional well—the financial logic is different. That single, expensive horizontal well can access a resource volume that would have required dozens of vertical wells to touch, making it more efficient and profitable over its lifetime.

Conclusion: Paying for Performance

The high sticker price of an unconventional well is the direct cost of overcoming geological challenges. Companies are paying a premium upfront for the advanced technology—horizontal drilling and multi-stage fracking—required to artificially create the permeability that nature provided for free in conventional fields. It’s a high-risk, high-reward model where the initial investment is the price of admission to vast, previously inaccessible resources.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness