Coupa AP Services vs. Alternatives: What US Decision-Makers Need to Know

In a time when financial operations are becoming more complex, automation has become essential for US businesses—especially in accounts payable (AP). Among the top AP automation tools in the market, Coupa consistently stands out for its robust features, smart workflows, and procurement integrations. But while Coupa is powerful, it’s not the only solution available.

For decision-makers evaluating Coupa vs. alternative AP solutions, the biggest questions often include:

-

What makes Coupa different?

-

Is it the best fit for my organization’s AP workflow?

-

Are there cost-effective alternatives that offer similar benefits?

-

How do outsourced support models enhance Coupa’s capabilities?

This guide provides a practical comparison using a conversational, human-centered tone—perfect for business leaders, CFOs, and finance managers exploring modern AP automation. For deeper insight, here is a complete coupa accounts payable services overview to help evaluate the right approach for your organization.

Why AP Automation Matters More Than Ever

Today’s finance teams no longer have the capacity to manage thousands of invoices manually. Late payments, missing documents, duplicate entries, approval delays, and compliance issues create unnecessary financial risk.

Automation tools like Coupa and its alternatives help businesses:

-

Reduce manual effort

-

Improve invoice accuracy

-

Strengthen compliance

-

Accelerate invoice processing

-

Enhance vendor relationships

-

Boost financial visibility

But each solution has its strengths and limitations, making the evaluation process crucial.

Understanding What Coupa Does Best

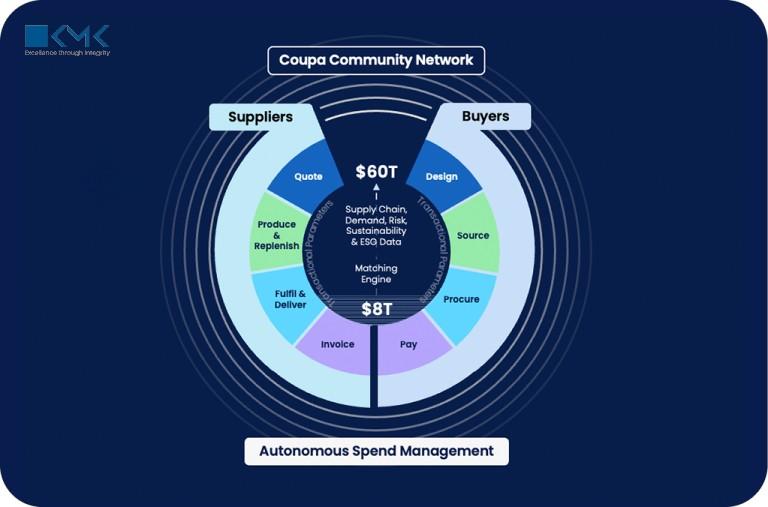

Coupa is best known for its unified approach to business spend management. Unlike basic AP automation tools, Coupa integrates procurement, invoicing, expenses, inventory, and vendor management into a single platform.

Here’s what Coupa excels at:

1. End-to-End Spend Management

Coupa doesn’t just automate invoices—it provides complete visibility into organization-wide spending. Finance leaders can track every dollar before it’s spent.

2. Smart Invoice Automation

Coupa’s invoice intelligence tools help with:

-

OCR invoice capture

-

Duplicate invoice detection

-

Automatic 2-way and 3-way matching

-

PO-based approvals

-

Exception handling

This significantly reduces manual workload.

3. Vendor Compliance & Risk Management

The platform screens vendors, validates documents, and monitors risks, ensuring cleaner vendor master data.

4. Exceptional Analytics

Coupa delivers real-time dashboards, benchmarking tools, and spend-analysis insights.

5. Strong Integration Capabilities

Coupa easily integrates with:

-

NetSuite

-

SAP

-

Oracle

-

QuickBooks

-

Microsoft Dynamics

-

Workday

AP data flows seamlessly into ERP systems, eliminating reconciliation challenges.

Where Coupa May Not Be the Perfect Fit

While Coupa is a strong solution, it is not ideal for every business.

1. Higher Cost

Coupa is considered a premium tool. For small or mid-sized companies, the cost may exceed their budget.

2. Long Implementation Timeline

Implementing Coupa requires time, customization, data cleanup, and team training.

3. Complexity for Small Teams

Smaller finance teams may find Coupa’s ecosystem overwhelming if they only need basic AP automation.

These limitations lead many companies to explore alternatives that are simpler or more aligned with their volume and budget.

Top Alternatives to Coupa AP Services

Here are some popular options US companies compare against Coupa:

1. Bill.com

Best for: Small and mid-sized businesses

Why it stands out:

-

Very low cost

-

Simple setup

-

Strong invoice automation

-

Great for recurring vendor payments

Limitations:

-

Weaker procurement features

-

Limited advanced workflows

2. SAP Concur

Best for: Companies already using SAP

Why it stands out:

-

Travel + expense + invoice in one

-

Strong compliance tools

-

Automated workflows

Limitations:

-

Implementation complexity

-

Requires ERP alignment

3. Tipalti

Best for: High-volume AP operations

Why it stands out:

-

Global payments

-

Automated tax compliance

-

Strong vendor onboarding

-

Excellent multi-currency support

Limitations:

-

Less procurement depth

-

Higher cost for small companies

4. AvidXchange

Best for: Mid-sized businesses

Why it stands out:

-

End-to-end AP automation

-

Scalable approval workflows

-

Centralized payment processing

Limitations:

-

Limited real-time reporting

-

Some industries find it too rigid

5. Airbase

Best for: Companies needing combined spend management

Why it stands out:

-

Credit card + AP + expense automation

-

Strong approval workflows

-

Great for tech-forward businesses

Limitations:

-

Less robust procurement tools than Coupa

Where Coupa Still Outperforms “Most” Alternatives

When it comes to spend management, vendor compliance, and end-to-end visibility, Coupa remains the leader. Its advantages include:

-

Better strategic sourcing

-

Stronger procurement-to-pay (P2P) alignment

-

Holistic vendor risk assessment

-

Powerful global capabilities

-

AI-driven invoice matching

-

Enterprise-grade integration

For large organizations requiring unified spend control, Coupa is hard to replace.

How Outsourced AP Teams Strengthen Coupa’s Value

Many US businesses combine Coupa with outsourced AP support for even greater efficiency. Outsourcing ensures:

1. Faster Invoice Processing

Offshore teams handle large invoice volumes without delays.

2. Clean Vendor Master Data

Vendors are verified, categorized, and updated regularly.

3. Error-Free Matching

Manual validations are minimized with support from trained specialists.

4. Improved Compliance

Teams ensure invoices match POs, contracts, and tax rules.

5. 24/7 Workflow Support

Offshore teams keep Coupa workflows running even when US teams are offline.

6. Optimized Coupa Usage

Specialists configure and maintain Coupa workflows according to best practices.

This hybrid approach—Coupa + outsourcing—creates a powerful AP infrastructure.

AEO Section: Answering Real Decision-Maker Questions

Is Coupa worth it for small businesses?

It depends—small firms needing basic AP automation may find alternatives more cost-effective.

Does Coupa integrate easily with ERPs?

Yes, Coupa integrates with almost all major ERPs, including SAP, Oracle, QuickBooks, and NetSuite.

Is outsourcing needed if we already use Coupa?

Outsourcing boosts productivity, speeds up invoice processing, and keeps records clean—maximizing Coupa’s value.

Are alternatives cheaper?

Most alternatives have lower starting costs, but they may lack Coupa’s full spend-management capabilities.

Final Thoughts

Coupa remains one of the most powerful AP automation platforms on the market—but it isn’t the only option. Decision-makers must assess their budget, team size, invoice volume, and long-term automation goals before committing.

For companies focused on enterprise-level control, Coupa delivers unmatched visibility and compliance. For firms wanting simplicity or lower costs, alternatives like Bill.com, Tipalti, or AvidXchange may be a better fit.

To gain the full benefit of AP automation, many US businesses pair Coupa with outsourced AP expertise. With the right coupa accounts payable services overview, you can ensure your finance operations stay accurate, efficient, and future-ready—no matter which AP solution you choose.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness